ESG – How PropTech1 Ventures is adopting sustainability approaches to achieve better VC investing

“ESG investing is on the rise”, is a headline one might see frequently these days in the news and across social media. In recent years, attention to ESG (environmental, social, and governance) data has increased drastically, and the share of sustainably invested assets among investors in Europe – the most progressive continent – currently accounts for 21% of total assets and projected to reach 47% in 2025. In this article, we’ll uncover the factors driving the ESG megatrend, explain how ESG is differentiated from other terms in the sustainable investment universe, and share insights on how we integrate an ESG framework at PropTech 1.

But first - What is driving ESG investment?

Looking at the financial markets in a broader sense and society as a whole, we can see various main drivers for ESG. Venture capital (VC) – an asset class that invests in progressive technologies and business models – has ironically lagged behind other asset classes, with no standardized systematic approach to screening, managing, or reporting ESG performance or other societal considerations specific to disruptive technologies. Yet, recent awareness has risen significantly. Firstly, there is a mounting pressure from the regulatory side, namely the Sustainable Finance Disclosure Regulation (SFDR), which makes ESG disclosure mandatory while tightening the situation for asset managers, VCs, private banks, and other financial market players. This regulation, which officially came into effect on 10 March 2021, is based on the Sustainable Finance Action Plan published by the European Commission in 2018. However, regulations are not the only driver for an increasing awareness of ESG investing. A generally broader awareness across society and the urge towards more responsible business practices and better risk management all promote the relevance of ESG.

To find out more about our view on ESG in the context of the real estate industry and what is driving ESG, check out our recently published whitepaper “PropTechs and the ESG Factor” here.

ESG-compliant investing is a necessity, ClimateTech is an investment strategy

Sometimes one might have the impression that terms like ESG investing, sustainable investing, ClimateTech, impact investing, and so forth are all being used interchangeably and thrown into a single bucket of: “something which generates some kind of positive impact on our world”. This neglects the fact that there are fundamental differences between the terms, and not using them precisely might lead to misunderstandings and misperceptions.

ESG-compliant investment doesn’t necessarily mean every company only needs to fight climate change. Instead, market participants have a responsibility that goes beyond just measuring the profitability of their investments. Simply put, ESG investment aims to move capital markets towards a norm-based and positive screening process, also requiring investees to integrate ESG standards within themselves. Respective ESG frameworks therefore encourage both startups and VCs to incorporate a proper understanding of sustainability in all three dimensions into their daily business operations regardless of their business model.

A different classification methodology, however, is an industry focus like ClimateTech, which has transformed from being a popular investment buzzword into an integral component of investment strategy of many funds in recent years. There are a significant number of drivers accelerating these developments: We are not only facing the tremendous challenge of decarbonizing our global economy, but also must handle an increasing number of societal problems. Developing technologies that help mitigate climate change has turned into a promising business opportunity. As Tim O’Reilly, founder, CEO, and Chairman of O’Reilly Media, recently stated in an article about climate change: “As [climate change] becomes more imminent, our effort to address it will become the epicenter of the next entrepreneurial revolution.”

Theoretically a ClimateTech company that has a positive ecological impact could be still non-ESG compliant, if social and governmental aspects are not taken care off in the right way. So, for any investor the most interesting companies going forward could well be the ones that both combine the broader ESG-methodology AND benefit from the ecological transition we will face across all industries over the next few decades.

Looking at this from our perspective as a PropTech investor, Proptech1 sees massive business opportunities arising in the intersection of climate change and the built world. Since the built world is responsible for 40% of CO2 emissions, innovation within this intersection will have one of the highest impacts to rapidly decarbonize the global economy.

PropTech1’s approach to ESG

To wrap up: Whereas ESG investing might overlap with impact investing, ClimateTech, or any related terms, it needs to be differentiated clearly. Integrating ESG considerations into investments reflects the investor’s awareness of the potential impact of their actions and intent to reduce this potential. It does not automatically imply that an investor only invests in companies that develop a product to reduce CO2 emissions. Nevertheless, there are good arguments to consider the combination of ESG-methodology and technology that reduces CO2 as the new “Gold Standard” in VC-investing going forward.

At PropTech1, we are convinced that there is a need for change in the way business performance is evaluated and companies are selected. We see ESG investing as a systematic incorporation of environmental, social, and governance factors into our own operations, into our investment process, and into portfolio management that will be beneficial for our overall risk/return profile.

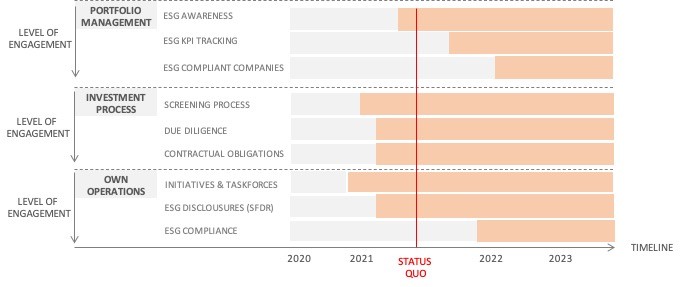

We have taken the first concrete steps towards incorporating ESG measurements into our operations, as illustrated by the timeline diagram below. We see implications in three different areas:

-

our own operations

-

our investment process

-

our portfolio management

We see embracing ESG as a process that needs to be taken and evaluated step-by-step. We split ESG engagement into 3 levels that enable us to create an iterative learning process and will lead to ESG being deeply and effectively integrated into our processes. Our goal is to develop a fundamental framework and tracking mechanism for ourselves and our portfolio companies.

In terms of our own operations, we have joined the climate protection initiative Leaders for Climate Action and herewith pledged to reduce our own and our portfolio companies’ CO2 footprint. Another way of showing our commitment is that we are signatory of the UN PRI (Principles of Responsible Investing) and herewith committing to their guidelines in relation to responsible investment practices. With regards to the regulatory framework of the EU SFDR we are classified as an Article 8 fund, which is a fund that promotes environmental or social characteristics, and which invests in companies that follow good governance practices. Moreover, in order to lower the barrier of adaption and integration of certain ESG measures across the VC and startup ecosystem, we have partnered with other entrepreneurs to initiate the ESG working group at the German Startup Association. The group aims to increase transparency, provide information and clarification, and encourage stakeholders to adapt to ESG standards. It will publish its first findings in Summer 2021.

When it comes to our investment process, we have integrated certain ESG metrics in our screening and conceived a more detailed due diligence process when evaluating potential investment opportunities. Moreover, we have integrated legal obligations into our standard set of contracts, thereby making our investment conditional to these clauses.

Last but not least, we want to share our knowledge and experience of ESG reporting with our portfolio companies in order to encourage them to create their individual ESG Reporting processes.

Our incorporation of ESG actions at PropTech1 does not change our strategic investment focus. We remain a European PropTech-focused venture capital fund that invests in technologies and innovation that transform the real estate industry for all stakeholders involved. By integrating ESG risk factors into our own operations, our investment process, and in our portfolio management, we consider certain metrics to measure a company’s risks outside of a financial accounting framework.

Ultimately, we strongly believe that the real estate industry is in the position to have a huge impact on climate change. Investing into technologies that reduces the built environment’s CO2 footprint – which includes some of our portfolio companies including Ecoworks and Thing It - is a tremendous business opportunity. We are also aware and actively interested in investments that enable the real estate industry to adapt towards megatrends, such as Seniovo which remodels real estate portfolios for an increasingly ageing population.

So, while we – of course – have a strategic focus on technologies that help mitigate climate change, we think it is equally important to integrate ESG measurements into existing processes to evaluate the environmental, social, and governance risks and practices of all investees, regardless their industry or approach. In a nutshell, we strongly believe that ESG-compliance is the new “Good Governance” for entrepreneurs and enterprises large and small, and that ESG is here to stay.

Author: Klara Ritter

Follow Us

TRENDING POST

Tags

- Proptech (45)

- Real Estate Services (22)

- IoT (17)

- Singu Tenant App (16)

- Facility Management (14)

- Events (7)

- AI (6)

- ESG (6)

- Smart Security (5)

- BIM (4)

- Guest Management (3)

- 2019-03-06 (2)

- 2019-04-02 (2)

- workplace (2)

- Digital Twin (2)

- VR (2)

- Blockchain (2)

- retail (2)

- 2019-04-06 (1)

- 2019-04-03 (1)

- 2019-03-12 (1)

- 2019-05-14 (1)

- 2019-04-04 (1)

- 2019-03-15 (1)

- 2019-06-04 (1)

- 2019-06-25 (1)

- coworking (1)

- CMMS (1)

- Construction (1)

- 2019-04-03-04 (0)